Real Estate Investments

Alternative Investments

Tired of the traditional real estate opportunities, you may be interested in other options.

Non-Traded REITs

lower volatility & less market correlation

A Real Estate Investment Trust (REIT) is a tax-advantaged investment vehicle with the purpose of buying and holding real estate. REITs are not taxed on most of their earnings, the taxes are paid by investors when they claim dividends as income.

Distribution to investors often have a portion that is non-taxable return of principle and second portion that is subject to taxes; which may meet the Qualified Business Income (QBI) rules and recieve a 20% tax deduction.

REIT’s often have lower growth rates than other investment vehicles, as they are only allowed 10 percent of their earnings to reinvest in growth.

They generate risk adjusted returns primarily though rental income, but also through the appreciation of held real estate assets.

What should you know about Non-Traded REITs?

- They are not listed on public exchanges

- They must still be registered with the SEC

- They are subject to the same IRS requirements

- They must return at least 90% of taxable income to shareholders

- They are quite illiquid for long periods of time.

- Managers are able to focus on long-term investment goals

Our team of professional advisors are available to answer questions you might have about REITs and other types of investment vehicles.

Private Placements

hassle free ownershiip

A Delaware statutory trust (DST) is a type of private placement investment that permits fractional ownership where multiple investors can share ownership in a single property or a portfolio of properties, which qualifies as replacement property as part of an investor’s 1031 exchange transaction.

Exchanging property into a Delaware statutory Trust (DST)

- Step 1 - Exchanger sells property, and proceeds are escrowed with a Qualified Intermediary

- Step 2 - Qualified Intermediary, through an agreement, transfers funds for purchase of replacement property

- Step 3 - Exchanger receives beneficial interest in a Deleware statutory trust

A Qualified Intermediary (QI) is a company that facilitates Section 1031 tax-deferred exchanges. The QI enters into a written agreement with the investor where the QI transfers the relinquished property to the buyer, while transferring the replacement property to the investor pursuant to the exchange agreement.

Key Benefits of a private placement Delaware Statutory Trust

- No management responsibilities (passive ownership)

- Generate passive income from commercial property (rental income)

- Access to institutional commercial properties (higher quality)

- Limited personal liability (nonrecourse loans)

- Divide your investment among multiple offerings (portfolio diversification)

- Alternative option if investor is unable to acquire the original property they identified (insurance policy)

- Eliminate any remaining profit "boot" by investing in a DST (low investment minimum)

- Meet the accelerated timelines of a 1031 exchange (efficient closing process)

RISK factors to consider*

- Real estate investments can be speculative; there are various economic factors that can negatively impact the value of a property

- As with all real estate, investments in a DST are considered "non-liquid"

- DST investors have limited rights and no control in the operation and management of the trust

- The manager of a DST may not modify the lease, make capital improvements or recapitalize the investment

- Professionally sponsored programs have experienced adverse developments in the past

* Investments are suitable for accredited investors only.

Qualified Opportunity Zones

Tax-advantaged investment solution

What are Qualified Opportunity Zones (QOZs)?

Defined under thee 2017 Tax Cuts and Jobs Act, qualified opportunity zones (QOZs) are economically-distressed communities where new investments, under certain conditiions, may be eligible for preferential tax treatment.

Locations qualify as opportunity zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretaary of the U.S. Treasury.

Qualified Opportunity Funds*

Potentially defer taxable gains

What is a Qualified Opportunity Fund (QOF)?

A Qualified Opportunity Fund is an investment vehicle that files either a partnership or corporation federal income tax return and is organized for the purpose of investing in QOZ property. At least 90 percent of its assets must be in QOZ businesses and assets.

What makes Qualified Opportunity Funds unique?

Investors with taxable gains from the sale or exchange of virtually any type of property, may potentially defer gains or receive a step-up in basis.

The following types of property may qualify:

- Stocks, Mutual Funds, Bonds

- Real Estate (excluding primary residence)

- Businesses

- Jewelry, Art, Cars

* Investments are suitable for accredited investors only.

1031 Exchange

Defer up to 100% of the Taxes Due

Section 1031 of the IRS tax code allows for the exchange of real property and the deferral of gains or losses on the property.

This applies to real estate that is used for business or held as an investment. To qualify properties must be exchanged for properties that are of like-kind.

Real properties generally are of like kind, regardless of whether they’re improved or unimproved. For example, raw land could be exchanged for a commerical building.

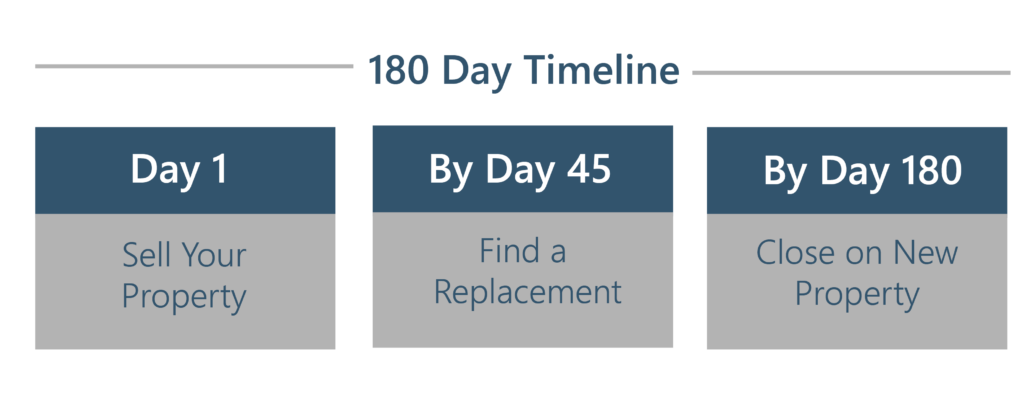

Timing is critial to receive tax deferral status.*

* There is no guarantee that an investor can complete an exchange within the 45 and 180 day time frame or that the acquisition of interests will qualify under section 1031 of the Internal Revenue Code.

Our Services

Benefiting the Lives of Those We Serve

Investment Management

A partner to oversee your money while you enjoy life.

Financial Planning

Helping you with life’s biggest decisions.

Tax Advising

Minimizing the impact of taxes across all areas of your life.

Consulting

Strategic advice within reach with your own personal CFO.